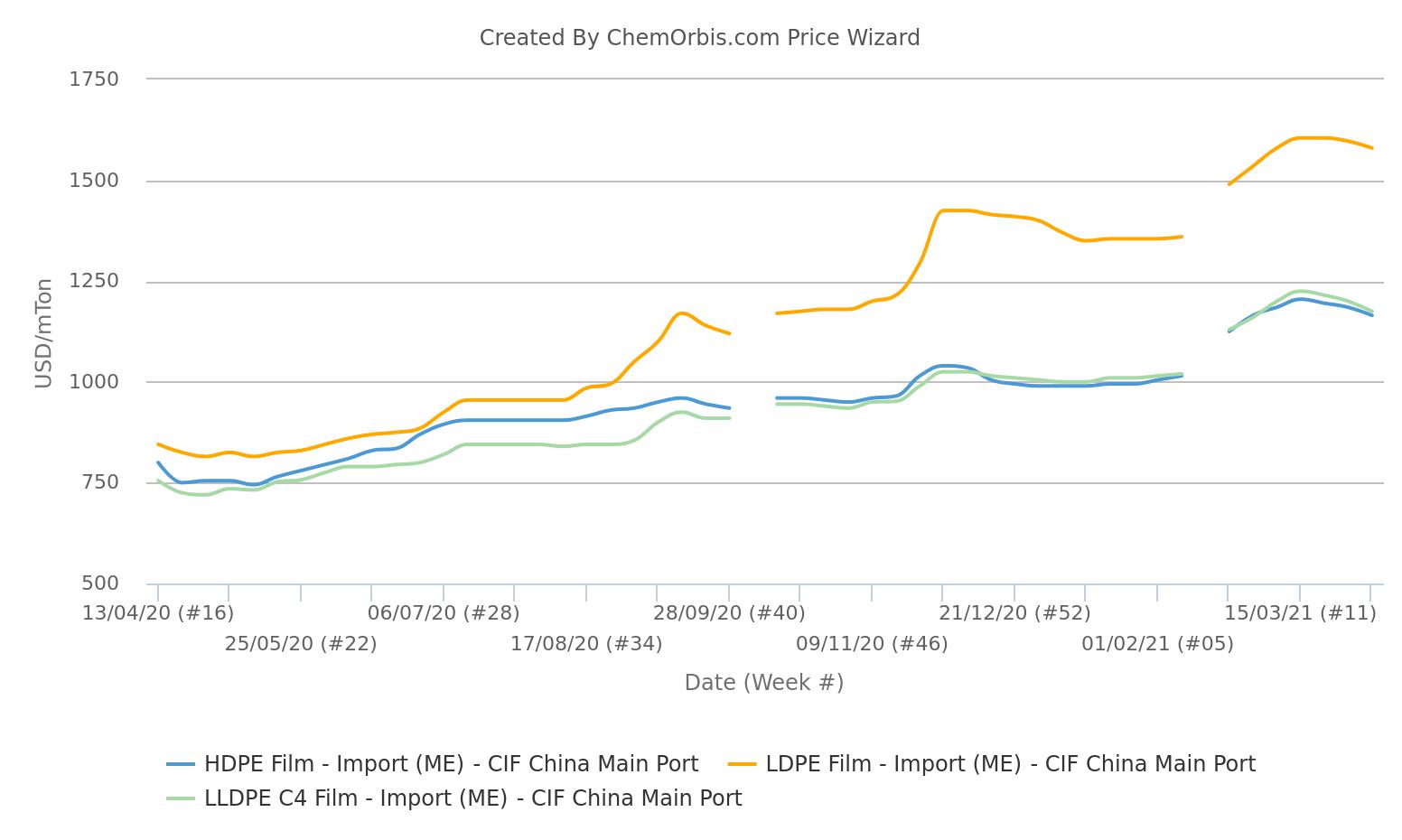

China import PE prices extend losses into April on lower costs

China import PE prices extend losses into April on lower costs

In China, the downtrend in the import PE market has remained intact for the third consecutive week although supply from overseas markets has been limited.

Spot prices have been dragged down by the weakness in crude oil futures amid rising supply from OPEC+, as well as growing COVID-19 risks around the globe.

The Tomb Sweeping holiday in the country has also limited buying activity further, pressuring the sentiment.

CIF China basis PE prices down for 3rd week

Holiday lull impacts buying activity

Holiday lull impacts buying activity

The three-day Tomb Sweeping national holiday in China started on April 4 and could be extended for a week or 10 days among market players.

The holiday lull has added to the already scant PE buying environment.

As a trader put it, “Import PE prices have weakened further at the beginning of the week. But buyers are still finding the current price levels too high to accept and not surprisingly, the number of the done deal is limited. We prefer to remain cautious about the outlook.”

Meanwhile, two major local producers’ combined polyolefin supply in China increased during the holiday period to stand at 920,000 tons on Tuesday, April 6. This level was up by 115,000 tons from Friday, April 2.

Sentiment bearish in upstream ethylene

Although spot ethylene prices on CFR China basis posted a slight increase during the final week of March, April started on a weak note considering weaker crude oil futures.

According to ChemOrbis Price Wizard, spot ethylene prices on CFR China basis have erased last week’s gain, losing $10/ton to stand at $1050/ton.